8 Payroll Management Recommendations

- August 5, 2024

- Posted by: admin

- Category: Uncategorized

8 Payroll Management Recommendations

Payroll policy should never be an afterthought. Your policy is a critical piece of your overall business strategy that outlines:

- The payroll process

- Salaries and wages

- Procedures for resolving mistakes

- How to calculate earnable vacation time

- How you classify employees

- When employees are paid

Failing to account for even one piece of your payroll strategy may lead to serious consequences. Paying the wrong tax rate could lead to penalties. Misclassifying employees could lead to fines and back pay. Paying late could cause employees to quit.

Whether you realize it or not, your payroll team has a direct influence on business success.

Payroll Management Recommendations

For a smoother payroll experience—and better business results, follow these recommendations:

1. Compute and gather payroll and tax data accurately.

Employers and payroll teams are responsible for:

- Employment taxes

- Social security deductions

- Medicare deductions

- Matching these deductions

Payroll taxes can vary by state, and a mistake could result in a penalty or audit. Work carefully around tax data to ensure consistency and accuracy.

2. Properly assess employee classifications.

Are your employees actually employees? And are your contractors actually contractors? Misclassification can result in penalties, taxes, and back pay.

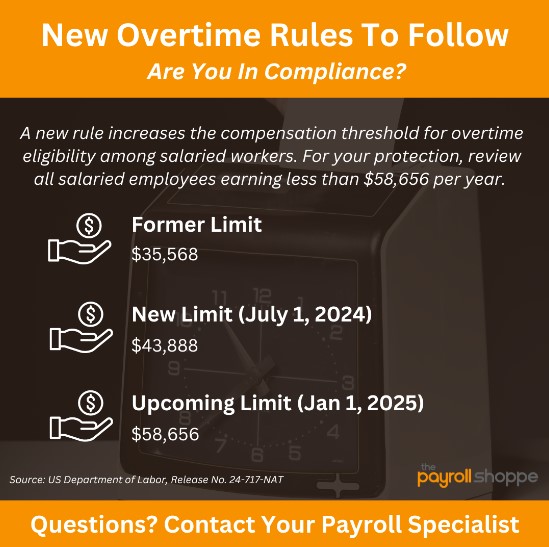

For your true employees, ask these questions while hiring and onboarding: Are they hourly or salaried? If they’re salaried, be mindful of the upcoming overtime threshold:

- July 1, 2024: Salaried employees earning less than $43,888 are eligible for overtime.

- January 1, 2025: Salaried employees earning less than $58,656 are eligible for overtime.

These thresholds will continue to increase in the coming years, so pay close attention to future blogs for updates!

3. Properly monitor employee attendance.

Employee scheduling and time tracking are essential for accurate payroll reports.

To learn more, dive into our Time & Attendance services to learn how our team can provide streamlined technologies that simplify time-tracking for both employees and management.

4. Create a payroll calendar.

At a minimum, your calendar should include:

- When timecards are due.

- When payday is scheduled.

- When open enrollment begins.

- When new hires are eligible for benefits. Some employee benefits may activate after a 90-day probationary period and some may activate after a year of employment, like a 401(k) match or safe harbor.

Having a thorough schedule keeps employees and the payroll team apprised of expectations from both sides.

5. Monitor and abide by federal, state, and local laws that regulate payroll.

This is especially tricky if you have employees in different states with different laws, but it’s a worthwhile investment.

In addition to avoiding penalties, this will also promote a fair and transparent workplace—improving credibility, reliability, and overall reputation among employees.

And remember: You can order updated labor law posters from us! Contact us to learn more.

6. Make payroll policy and related documents easily accessible.

Ensure that all payroll policies and related documents are stored in a centralized, easily accessible location, such as a cloud-based HR portal.

Regularly update these documents and notify employees of any changes to keep everyone informed and compliant. Providing easy access helps reduce confusion and enhances transparency within your organization.

7. Ensure employees receive their direct deposit or paychecks accurately and on time.

This may sound obvious, but it’s worth emphasizing.

Employees who are paid late or incorrectly are more likely to leave your company. In fact, one study found 49% of employees say they’d look for a new job after only two payroll mistakes.

8. Plan for year-end tax reporting.

You’re accounting and finance teams are responsible for two forms:

- W-2s for employees

- 1099s for contractors

They’re both due on January 31 each year, so start planning early. If you find any discrepancies, resolve them before the end of the year.

Again, your role is critical in employer-employee relationships. Accurate, timely year-end tax reporting is essential to employees and contractors who require these forms to file their tax returns.

Find Additional Payroll Support

The best way to streamline your payroll efforts is to outsource the heavy lifting to a payroll partner you can trust.

Rely on our team at The Payroll Shoppe. Our experience, services, and unwavering commitment to outstanding customer service means you’ll always have an excellent experience.

Contact us to get started!