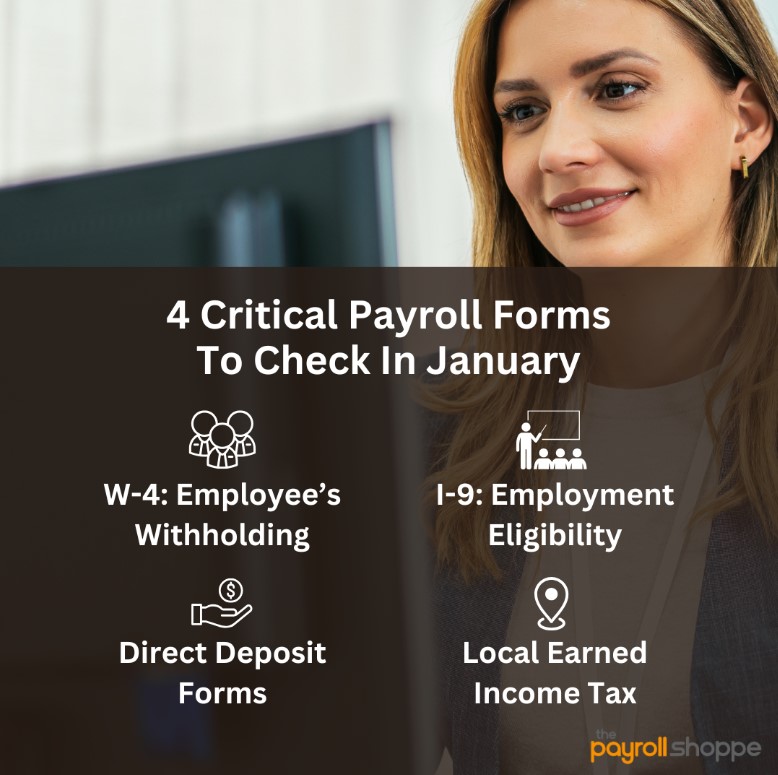

4 Critical Payroll Forms to Check In 2025

Happy New Year! Early January is always a time for celebration, as a new year offers a fresh start and the promise of new opportunities.

But it also means new payroll pressures.

As we turn the calendar to another tax year, your payroll team should double-check that all employee data is accurate and up-to-date.

Otherwise, a single accounting error could lead to reduced profitability or even audits and fines from the federal government.

Forms to Check In January

To keep your payroll operations running smoothly, double-check the accuracy of these mission-critical forms:

W-4: Employee’s Withholding Certificate

About Form W-4: Form W-4 is completed by employees to outline critical tax information, including marriage status, employment at other jobs, dependents, and other adjustments. Ultimately, Form W-4 is designed to help you withhold the correct amount of taxes on every paycheck.

Where to Get the Latest Version of Form W-4: https://www.irs.gov/forms-pubs/about-form-w-4

I-9: Employment Eligibility Verification

About Form I-9: Form I-9 is designed to verify an employee’s identity and their employment eligibility to ensure they’re authorized to work in the United States. This form captures data points such as their US social security number, citizenship/immigration status, and other critical information.

Where to Get the Latest Version of Form I-9: https://www.uscis.gov/i-9

Check out our Hiring & Onboarding services to learn how The Payroll Shoppe can simplify your new hire process.

Direct Deposit Forms

About Direct Deposit Forms: While there’s no standardized federal form for setting up employee direct deposits, it’s important to regularly check with employees to see if they need to update their information.

Common reasons employees need to update their direct deposit data include:

- They’ve switched banks.

- They want their paycheck to go into a different account.

- They’ve married, divorced, or experienced another life event that has caused them to adjust their finances.

In addition, employees can direct their funds into multiple accounts, including:

- Checking

- Savings

- Christmas fund

Ask staffers where their money should go for greater clarity.

Our Self-Service Payroll App can help you stay up to date on critical employee direct deposit information!

Local Earned Income Tax Withholding

About Local Earned Income Tax Withholding: Local earned income tax withholding is collected and monitored by local tax authorities on the municipal level, and requirements change from city to city, which can make payroll especially challenging for companies operating in multiple locations.

Find Additional Support

To access even more support on your payroll forms, contact us! Our team is available to streamline your payroll efforts through superior customer service and knowledgeable specialists.