Payroll Compliance: How to Keep Up With Shifting State And Federal Regulations

Here’s something terrifying to consider: According to the IRS, 33% of employers make payroll mistakes—which led to billions of dollars in assessed collections and payments back in 2023. Needless to say: Payroll compliance is a mission-critical objective, and a payroll compliance practitioner is a must-have position within your company.

But remaining in compliance can feel like a bewildering task. To illustrate, here’s just a small sample of state-wide regulatory updates we’ve tracked in the last 12 months:

- California – Minimum Wage

- California – Whistleblower Protections

- California – Workers’ Compensation (Check out our Workers’ Compensation Services for additional support)

- DC – Paid Family Leave

- DC – Protecting Pregnant Workers Fairness Act

- Illinois – Child Labor Laws

- Illinois – Pay Scale and Benefits Transparency

- Massachusetts – Paid Family And Medical Leave

- Massachusetts – Veterans Benefits

- Missouri – Minimum Wage

- New York – Minimum Wage

- New York – Paid Prenatal Leave

And that’s the small list. A whopping 19 states (38%!) enacted minimum wage increases on January 1, 2025, and three more states are following suit later this year.

Although falling out of compliance can be costly, as we’ll see in a moment, it’s also possible to remain in compliance all year long, no matter what sort of legislation is enacted.

What Happens If You Fall Out of Payroll Compliance?

Falling out of compliance with worker laws can literally ruin your business overnight. If caught, the best case scenario is damaged public reputation and embarrassment.

At worst, though, is an expensive litany of restitution, fines, and penalties. In fact, here’s how a few companies are suffering in states across the country, thanks to authorities recently catching them in the act:

California

A San Diego construction company has been cited for $1.7 million after failing to properly pay workers and violating overtime laws. (Source: State of California Department of Industrial Relations)

Colorado

Denver-based gig staffing company Instawork is on the hook for $2.3 million in restitution, penalties, and fines after 20,000 violations of shorting worker wages. (Source: The Denver Post)

Massachusetts

Four companies were recently forced to pay $690,000 in restitution and more than $274,000 in penalties for botching sick time laws and other worker protections. (Source: MassLive)

North Carolina

Two employers are now paying back $139,000 after the U.S. Department of Labor determined the companies shortchanged 65 workers—and even threatened to seize their passports. (Source: U.S. Department of Labor)

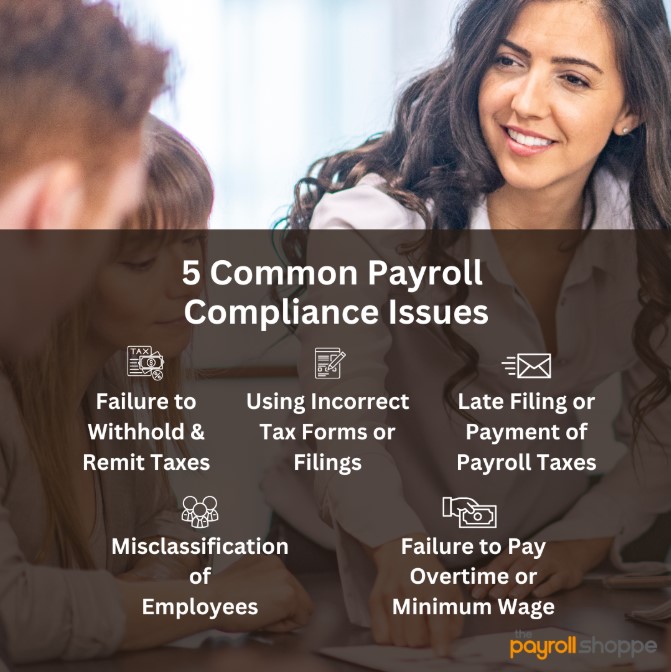

Five Common Payroll Compliance Issues

There are numerous ways employers could violate payroll regulations—even when they’re trying their best to remain compliant. Here are five of the most common violations companies are dinged for:

1. Failure to Withhold and Remit Taxes

What It Is: As the employer, you’re responsible for withholding federal income tax, social security tax, and medicare tax. Failing to do so could result in fines.

Potential Penalties: Penalties typically include the amount of taxes not withheld plus interest and a percentage-based fine (e.g., up to 15% per quarter under the IRS failure-to-deposit penalty structure).

2. Late Filing Or Payment of Payroll Taxes

What It Is: Employers must file payroll tax forms and make tax payments by specific deadlines set by the IRS or state agencies. Filing or paying late—whether due to administrative errors, lack of awareness, or deliberate avoidance—violates payroll laws and can trigger financial penalties.

Potential Penalties: Fines can vary on the state and federal levels, but the IRS typically imposes a fine of 2%-15% of the unpaid taxes.

3. Incorrect Tax Forms or Filings

What It Is: Filing incomplete, inaccurate, or outdated tax forms (such as W-2s, 1099s, or Form 941) is a common mistake. This can happen if the wrong employee information is provided, calculations are incorrect, or changes in tax law aren’t reflected in filings. Errors can lead to delayed refunds, audits, and penalties.

Potential Penalties: The penalty depends on the size of the employer and how late the corrected filing occurs (e.g., $50-$290 per form, capped based on company size).

4. Misclassification of Employees

Note: This is one area managers, accounts payable, and payroll should communicate. Independent contractors might not pop up on your radar in the payroll department, but they could legally be your responsibility!

What It Is: Misclassifying employees as independent contractors can occur when employers attempt to avoid payroll taxes or simply misunderstand the classification criteria. Employees are entitled to specific protections and benefits that contractors are not, and misclassification can result in significant liabilities.

Potential Penalties: Misclassifying employees as independent contractors can lead to back taxes owed, along with additional penalties for Social Security, Medicare, and unemployment insurance.

5. Failure to Pay Overtime or Minimum Wage

What It Is: Employers must comply with federal and state laws regarding minimum wage and overtime pay. This includes ensuring employees are properly classified as exempt or non-exempt under the Fair Labor Standards Act (FLSA) and paying wages accordingly. Ignoring these regulations can lead to wage disputes, employee lawsuits, and government intervention.

Potential Penalties: Violations of the Fair Labor Standards Act (FLSA) can lead to fines, back pay, and liquidated damages equal to the amount of unpaid wages. Willful violations can result in a civil penalty for each violation.

How to Stay In Payroll Compliance

Remaining in compliance with the latest payroll regulations doesn’t happen by accident. Follow these three tips to ensure consistent, year-round payroll compliance:

1. Keep Track of Regulatory Updates

The best thing you can do as a business owner is monitor the websites for:

- Local Regulatory Bodies

- State Regulatory Bodies

- Federal Regulatory Bodies

Of course, you can also remain in close contact with your CPA and tax advisors throughout the year for ongoing updates. We’ll also keep you in compliance if you decide to work with us at The Payroll Shoppe!

While you’re focused on regulatory updates, make sure you also update your labor law/OSHA posters on a regular basis. These posters contain critical information for your employees, and failing to post updated posters in a visible area could lead to hefty fines.

Potential fines include:

- Family and Medical Leave Act poster: $216 per violation

- Migrant and Seasonal Agricultural Worker Protection Act poster: $3,126 per violation

- Occupational Safety and Health Act poster: $16,550 per violation

- Employee Polygraph Protection Act poster: $26,262 per violation

Remember: We can help you remain in compliance with labor law posters!

2. Subscribe to Industry Newsletters

Subscribing to a payroll newsletter is a low-effort, passive strategy for monitoring critical payroll updates. Some of our favorites:

- Our Newsletter – We’re biased, but our monthly newsletter is packed with helpful articles to enhance your payroll processes!

- HR Morning & Keep Up To Date On Payroll – Rely on HR Morning’s Keep Up To Date On Payroll for a twice-a-month update on evolving payroll regulations across the country.

- KPMG Payroll Insights – This monthly publication from KPMG LLP’s Employment Tax practice offers the latest in payroll and employment taxes.

3. Work With Us At The Payroll Shoppe

Consider us your full suite of Payroll services—including your payroll compliance practitioners. From HR support to Time & Attendance, we’ll manage the nuances of your back office operations to ensure employees are paid the right amount at the right time and that local, state, and federal agencies receive the proper information.

Contact The Payroll Shoppe

Make us your payroll compliance practitioners. At The Payroll Shoppe, you’ll benefit from our hands-on expertise and personalized customer service, ensuring you receive timely feedback to your questions and professional guidance for your business.

Contact us today to learn more!