The Average Monthly Cost of Employee Benefits

(And How You Can Control It)

Since 2021, employers throughout the United States have been in a “Perks Arms Race”—a rampant, wide-spread scramble to attract and retain top talent during The Great Resignation by offering greater benefits, salaries, and perks.

But it doesn’t seem to be working in these employers’ favor. Research from the Bureau of Labor Statistics shows 3.5 million people quit their jobs in February 2024—roughly 121,000 per day.

It seems like an unwinnable war. Employees say they want better benefits, and employers know they want better benefits, but these same employers struggle with communication, enrollment, and education.

Even worse, the average monthly cost of employee benefits is constantly spiraling out of control.

With better tools, however, like the ones our partners at Employee Navigator offer, employers can better educate teams while offering value well beyond salary alone. As such, they can better retain talent—and increase revenue in the process.

Table of Contents

What’s the Average Monthly Cost of Employee Benefits?

Problems With Benefits Expenses & Education

Benefits of Better Benefits Educations

How Employee Navigator Saves You Time & Money

Case Study: Saving Time With Employee Navigator

Access Better Benefits And Payroll With The Payroll Shoppe

What’s the Average Monthly Cost of Employee Benefits?

The average monthly cost of employee benefits varies by employer and industry, but research from the Bureau of Labor Statistics offers this helpful figure: Employee benefits generally account for 29.4% of an employee’s total compensation.

So, if an employee’s total compensation is about $4,000 per month, their employee benefits might cost $1,176 per month.

The true costs are a little bit higher, however.

With a 35-hour workweek, research from BLS shows employers spend:

- $1,798.69 per month for private industry workers

- $1,997.36 for civilian workers

- $3,322.87 for state and local government workers

That’s already a large amount of money, but when you factor that into your entire workforce, it’s even more!

Problems With Benefits Expenses & Education

Despite the costs involved, benefits have never been more critical. Put simply: Employees want them. According to a 2022 Employee Benefits Survey Report:

- 87% of employees value health insurance.

- 72% value dental insurance.

- 63% value mental health benefits.

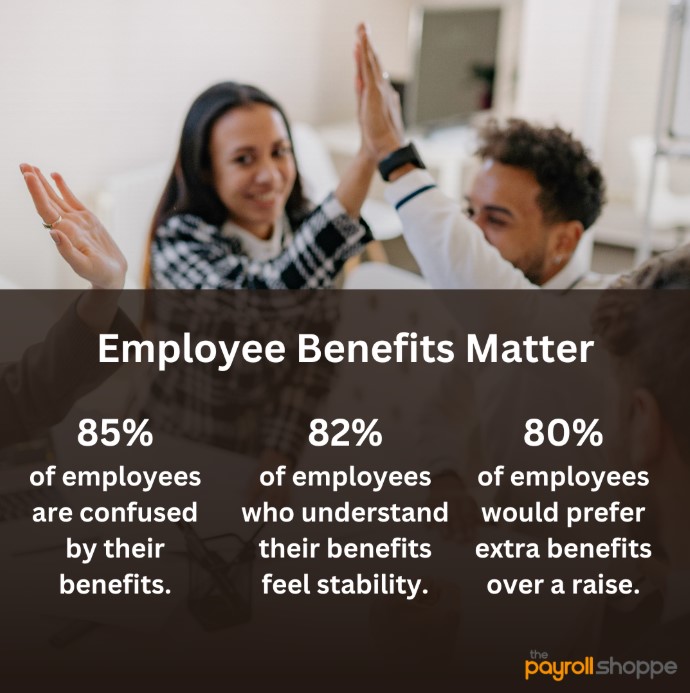

Although these benefits are important, they’re not quickly understood. A whopping 85% of employees say they’re confused by their benefits policy details.

And it doesn’t look like many companies have a solidified plan to solve that issue. A surprising 44% of managers say they lack the time to educate team members on benefits, and 39% say they lack the resources necessary to do so.

Benefits of Better Benefits Education

Despite all of the challenges around communication and education, finding a way to overcome them can result in serious financial gains for your company.

According to 2023 research from MetLife:

- 82% of employees who understood their benefits said they felt a greater sense of stability.

- 76% of employees who understood their benefits package reported being happy.

Imagine that: You could make your employees happy just by making sure they understand the benefits they’re already receiving!

But there are other benefits as well. According to Glassdoor:

- 80% of employees say they would prefer extra benefits over a pay raise.

- 60% of employees say benefits are a decisive factor in accepting a job.

With that in mind, starting your benefits education even during the new employee interview process can spell long-term gains for your company, as it can boost employee knowledge, morale, and retention!

How Employee Navigator Saves You Time & Money

The research shows investing in benefits education, clarity, and simplification can make employees happier and more productive—while cutting costs for your company.

That’s where our friends at Employee Navigator can help. As an all-in-one benefits, human resources, and compliance tool, Employee Navigator is designed to streamline benefits onboarding, administration, and employee satisfaction.

Some of its biggest benefits include:

1. Simplified Setup

Setting up Employee Navigator is a simple process, and onboarding employees is a cinch. Employee Navigator eliminates the paper-intensive processes and digitizes virtually all steps for enhanced speed and reduced administrative burden, especially during open enrollment.

2. Streamlined Employee Education

Benefits packages are complex, but explaining them doesn’t have to be challenging. Employee Navigator offers individualized support for you and your employees by providing a virtual agency call center to manage all employee questions. The result: A robust, consistent, and easy-to-access education center for your employees.

3. Employee Monitoring

You want to ensure employees access as many of their benefits as possible to maximize their job satisfaction and retention. Employee Navigator offers reports on which employees haven’t picked a plan, empowering you to offer extra support during enrollment periods.

4. Employee Self-Service

Team members can easily learn about their benefits options and sign up for the plans that best suit their needs within Employee Navigator’s convenient self-service portal.

Case Study: Saving Time With Employee Navigator

Here’s how one company has seen major benefits from working with Employee Navigator:

The Problem:

A benefits consultant was bogged down by messy, hand-written paperwork and missed enrollments. The hurdles added up every year, and the complicated processes led to lost business.

The Solution:

Switching to Employee Navigator completely digitized the process, removing sloppy recordkeeping and streamlining employee access to benefits. Thanks to the digital portal, all employee data was immediately sent to the health insurance companies, ensuring employees never missed enrollment.

Access Better Benefits And Payroll With The Payroll Shoppe

If you’re ready for better benefits management and payroll where customer service still matters, contact us! We’re preferred Employee Navigator partners, meaning we can help you tackle your entire compensation package—from Payroll to benefits.